Financial Planning for Americans Living in Vancouver

Vancouver’s thriving economy, temperate climate, and proximity to the Pacific make it one of North America’s most desirable cities. It’s no surprise that many Americans have chosen to make it their home—whether for work, family, or lifestyle. But while the move may be seamless in terms of language and culture, cross-border financial planning between the United States and Canada introduces layers of complexity that can trip up even the most financially savvy expats.

From dual tax reporting to investment restrictions and estate considerations, U.S. citizens living in Canada must navigate two financial systems that often overlap—but don’t fully align. Let’s unpack the core principles of U.S.-Canada financial planning, explore how to coordinate cross-border investments, and examine the role of a specialized Canada–U.S. expat advisor in building long-term success.

1. Key U.S.–Canada Tax Planning Principles for Expats

When an American moves to Canada, their tax situation instantly becomes more complicated. The United States taxes based on citizenship, while Canada taxes based on residency. This creates a dual filing obligation that requires careful coordination to avoid double taxation, penalties, or compliance issues. This is where Canada U.S. Tax Planning becomes essential to managing global income effectively.

Understanding Dual Tax Residency

If you’re a U.S. citizen living in Vancouver, you are considered a Canadian tax resident once you establish significant residential ties—such as a home, spouse, or dependent in Canada. This means you must file and pay Canadian taxes on your worldwide income. At the same time, the U.S. continues to require you to file annual tax returns with the Internal Revenue Service (IRS), regardless of where you live.

This dual tax residency triggers an intricate web of reporting obligations, including:

- U.S. Form 1040 – Annual income tax return for all U.S. citizens

- Form 8938 (FATCA reporting) – Disclosure of foreign financial assets over specific thresholds

- FinCEN Form 114 (FBAR) – Reporting of foreign bank and investment accounts exceeding $10,000 USD in aggregate

- Form 3520 and 3520-A – Reporting of foreign trusts and some Canadian registered accounts

The Canada–U.S. Tax Treaty: Your Safety Net

Fortunately, the Canada–U.S. Tax Treaty helps mitigate double taxation. It establishes which country has the primary right to tax specific income types and offers credits and exemptions. For example:

- Employment Income: Taxed primarily in the country where the work is performed.

- Pensions and Social Security: Coordinated through treaty articles to avoid duplicate taxation.

- Capital Gains: Usually taxed in the country where the individual is a resident at the time of the sale.

The treaty also includes tie-breaker rules for dual residents, determining which country is considered your primary tax home for treaty purposes. This distinction is critical when structuring investments, estate plans, and retirement accounts under effective Canada U.S. Financial Planning principles.

Foreign Tax Credits and Avoiding Double Taxation

To prevent double taxation, U.S. taxpayers in Canada typically rely on foreign tax credits (FTC). Canada’s income tax rates are generally higher than those in the U.S., so most expats find that their Canadian tax liability offsets much of their U.S. tax bill.

However, timing differences can create mismatches. For instance, Canada may recognize certain income or capital gains at a different time than the U.S., leading to potential discrepancies. Skilled Canada U.S. Tax Planning ensures that credits align properly and that carryovers are maximized for future years.

Registered Accounts: RRSPs, TFSAs, and RESPs

Canada offers several tax-advantaged investment vehicles, but their U.S. treatment varies dramatically:

- RRSP (Registered Retirement Savings Plan):

Under the tax treaty, Americans can defer U.S. taxation on income earned inside an RRSP until withdrawal, provided proper elections are filed (formerly via Form 8891, now recognized automatically). - TFSA (Tax-Free Savings Account):

While tax-free in Canada, TFSAs are not recognized as tax-sheltered by the IRS. Income earned inside a TFSA is fully taxable to the U.S., and the account may even be treated as a foreign trust, triggering complex reporting. - RESP (Registered Education Savings Plan):

Similarly to TFSAs, RESPs are viewed as foreign trusts by the IRS, creating additional filing burdens and potential taxation of the income inside.

Given these inconsistencies, most U.S. citizens in Vancouver need professional help to determine which Canadian accounts make sense within a cross-border portfolio. Incorporating Canada U.S. Financial Planning strategies helps ensure these accounts fit within a unified global wealth structure.

2. Coordinating Investments Under Canada–U.S. Wealth Management

Tax is just one piece of the puzzle. Coordinating investments across two regulatory systems requires both compliance awareness and thoughtful portfolio construction. Without planning, American expats can inadvertently create punitive tax situations that effective Canada U.S. Financial Planning can prevent.

Avoiding PFIC Traps

One of the most common pitfalls for U.S. investors in Canada is the Passive Foreign Investment Company (PFIC) rule. Canadian mutual funds and ETFs (even those purchased through a local advisor) typically qualify as PFICs under U.S. tax law.

PFICs are heavily penalized: income is taxed at the highest marginal U.S. rate, with additional interest charges applied retroactively. Reporting is also onerous, requiring Form 8621 for each holding annually.

To avoid PFIC exposure, many expats either:

- Maintain U.S.-domiciled investment accounts,

- Work with a cross-border investment firm licensed in both countries, or

- Hold Canadian ETFs or mutual funds only in registered accounts like RRSPs (where treaty deferral applies).

Currency Diversification and Exchange Risk

Living in Canada means earning and spending primarily in Canadian dollars (CAD), while many Americans still hold U.S. dollar (USD) assets and liabilities. This dual-currency dynamic introduces exchange rate risk that can significantly affect returns.

A well-structured Canada U.S. Financial Planning strategy might:

- Hold core long-term investments in USD for retirement needs,

- Use CAD cash and short-term investments for everyday expenses,

- Hedge currency exposure using ETFs or multi-currency accounts, and

- Strategically time conversions to reduce tax impact when repatriating funds.

Exchange rate swings can have tax implications as well. The IRS considers currency gains on personal transactions (like moving money between currencies) taxable capital gains—even if the purpose is simply living abroad. A cross-border advisor can help track and minimize these exposures.

Retirement Planning Across Borders

Coordinating retirement accounts is especially complex when living in Canada as a U.S. citizen. Many expats hold a mix of:

- U.S. retirement accounts – such as 401(k)s, IRAs, or Roth IRAs

- Canadian retirement accounts – such as RRSPs or pensions

Each has unique tax treatment under both systems. Key considerations include:

- RRSPs and 401(k)s:

Both countries allow deferral of tax until withdrawal, but you must coordinate withdrawals to prevent mismatched taxation. - Roth IRAs:

Generally tax-free in the U.S., but not always recognized as tax-free by the CRA if contributions are made after becoming a Canadian resident. - Employer Pensions:

Canadian pensions are taxable in both countries, but the treaty often grants Canada the primary taxing right, with U.S. credits applied accordingly.

Strategic sequencing of withdrawals, along with Roth conversions or rollovers before moving, can save thousands in long-term taxes and exemplify strong Canada U.S. Tax Planning in action.

Estate and Gift Tax Coordination

Estate planning adds another layer of complexity. The U.S. imposes estate and gift taxes on worldwide assets owned by citizens, even if they live abroad. Canada, on the other hand, does not levy an estate tax but instead treats death as a deemed disposition—triggering capital gains tax on appreciated assets.

To coordinate both systems effectively under Canada U.S. Financial Planning:

- Consider cross-border wills drafted by lawyers in each jurisdiction.

- Use trusts or joint ownership structures carefully, as they can trigger reporting obligations on both sides.

- Stay mindful of U.S. lifetime gift exemptions ($13.61 million USD in 2024) and Canadian deemed disposition rules.

These differences can significantly affect how property, real estate, and business assets are transferred to heirs. A unified plan ensures compliance in both countries and avoids double taxation on death.

3. Navigating Canadian Residency and IRS Obligations

Establishing tax residency in Canada is not just a matter of where you live—it’s about the depth of your ties. The Canada Revenue Agency (CRA) determines residency based on factors like:

- Primary residence in Canada

- Spouse or dependents living in Canada

- Employment, social, and economic connections

- Duration and regularity of stays

Once you’re a resident, you’ll be taxed on worldwide income. But even nonresidents can face Canadian tax on Canadian-sourced income such as rent, employment, or dividends.

Determining Your Tax Residency

The U.S.–Canada Tax Treaty’s “tie-breaker rules” help resolve situations where you might qualify as a tax resident in both countries. The hierarchy typically goes:

- Permanent home location

- Center of vital interests (family, economic ties)

- Habitual abode

- Nationality

This framework ensures only one country treats you as a resident for treaty purposes—critical for tax filings and determining where income is primarily taxed. Understanding and applying these criteria properly is a fundamental part of effective Canada U.S. Tax Planning.

Social Security and CPP Coordination

Americans working in Canada contribute to the Canada Pension Plan (CPP) rather than U.S. Social Security, but the Totalization Agreement between the two countries prevents double contributions. It also allows crediting of work periods across both systems to qualify for benefits.

When it comes time to collect, you may receive a pro-rated benefit from each country. However, taxation rules differ: Canada taxes CPP benefits as income, while the U.S. taxes a portion of Social Security based on total income levels. Coordinating timing and claiming strategies is a core element of successful Canada U.S. Financial Planning.

Healthcare and Insurance Planning

Once you establish Canadian residency, you become eligible for provincial healthcare coverage, such as MSP (Medical Services Plan) in British Columbia. However, the system may not cover all services—especially for U.S. expats who travel frequently or maintain ties in both countries.

Consider supplementing with:

- Private extended health insurance for dental, prescriptions, and travel;

- Cross-border health plans if you regularly seek care in the U.S.; and

- Long-term care planning that accounts for differing systems and costs.

Health insurance also intersects with tax planning: U.S. citizens no longer qualify for Affordable Care Act subsidies while living abroad but can claim the foreign earned income exclusion (FEIE) or foreign tax credits to offset potential U.S. obligations. Integrating healthcare within Canada U.S. Financial Planning ensures both coverage and tax efficiency.

Business Ownership and Self-Employment

Many Americans move to Vancouver as entrepreneurs or remote workers. But owning or operating a business across borders introduces additional layers of complexity:

- Canadian Corporations Controlled by U.S. Persons (CFC rules):

The IRS requires detailed reporting (Form 5471) for ownership in foreign corporations. - U.S. LLCs in Canada:

While transparent for U.S. tax purposes, LLCs are often treated as corporations in Canada, leading to double taxation unless carefully structured. - GST/HST and Payroll:

Canadian businesses must collect sales tax (GST or HST) and comply with payroll requirements, which can differ sharply from U.S. systems.

An integrated Canada U.S. Tax Planning approach prevents mismatches and optimizes after-tax income.

4. The Role of a Canada–U.S. Expat Advisor in Long-Term Success

Managing life across two tax systems requires specialized expertise. Traditional financial advisors—whether Canadian or American—often lack the licensing or tax knowledge to coordinate both sides effectively. That’s where Canada–U.S. expat advisors come in, offering the comprehensive Canada U.S. Financial Planning perspective needed for cross-border success.

What Makes an Expat Advisor Different

A true cross-border financial advisor is licensed in both Canada and the United States and understands the interaction between the IRS, the CRA, and the tax treaty. Their expertise spans:

- Cross-border portfolio construction and investment management

- Tax-efficient withdrawal sequencing from U.S. and Canadian accounts

- Estate planning and trust coordination

- Currency management and cash flow planning

- Cross-border retirement projections in both USD and CAD

Working with an advisor who can see the “whole picture” ensures that your investments, taxes, and estate plans align under a unified framework—rather than being optimized separately for each country. This is the foundation of high-quality Canada U.S. Financial Planning.

Integrated Financial Planning Services

Cross-border advisors typically provide integrated services that include:

- Dual-country tax coordination: Working with accountants familiar with both IRS and CRA filings to ensure compliance and avoid overlap.

- Investment oversight: Managing assets in both countries to prevent PFIC exposure and currency misalignment.

- Retirement modeling: Simulating different tax outcomes for withdrawals, conversions, or relocations.

- Estate and insurance planning: Ensuring beneficiaries and ownership structures meet both countries’ legal standards.

For example, an advisor might help a U.S. citizen in Vancouver determine whether to contribute to an RRSP or invest through a U.S.-based IRA, depending on income levels, long-term residency goals, and currency exposure—all key aspects of Canada U.S. Tax Planning.

The Value of a Coordinated Team

Because cross-border planning touches multiple disciplines, the most effective advisors collaborate with a network of professionals—including cross-border accountants, estate lawyers, and immigration consultants. This team approach ensures every aspect of your financial life remains compliant and optimized, even as tax laws evolve.

For instance, suppose an American expat sells a rental property in Seattle while living in Vancouver. The transaction could trigger capital gains in both countries, subject to foreign tax credits and differing exchange rates. A coordinated advisory team ensures the right forms are filed, the timing of income recognition is aligned, and any proceeds are reinvested efficiently under the treaty framework—hallmarks of strong Canada U.S. Financial Planning.

Planning for Mobility: Returning or Retiring Abroad

Many Americans in Vancouver eventually face decisions about whether to return to the U.S., retire in Canada, or split time between both countries. Each scenario has unique implications:

- Returning to the U.S.: You may need to unwind Canadian investments and close certain accounts not supported by U.S. institutions.

- Staying in Canada: Long-term planning should emphasize minimizing U.S. estate exposure and optimizing withdrawals from U.S. accounts.

- Dual-country lifestyle: Requires active currency management, tax filing in both jurisdictions, and cross-border healthcare and estate planning.

A cross-border advisor can model each scenario, helping you plan transitions efficiently while maintaining compliance—a central goal of Canada U.S. Financial Planning.

5. Case Study: An American Professional in Vancouver

Consider Emily, a U.S. citizen who moved from Seattle to Vancouver to work in tech. She earns CAD 180,000 annually, contributes to her employer’s RRSP, and holds a Roth IRA and a 401(k) from her time in the U.S.

Without guidance, Emily faces several challenges:

- U.S. Tax Filing: She must continue filing a U.S. return, reporting both her Canadian salary and investment income.

- Canadian Tax Filing: As a Canadian resident, she must declare global income, including her Roth IRA earnings (which the CRA may tax).

- Double Taxation Risk: She needs to coordinate foreign tax credits properly to avoid paying tax twice on the same income.

- Investment Restrictions: Her Canadian bank warns that holding U.S.-based mutual funds may not comply with local securities regulations.

- Estate Planning: Her existing U.S. will doesn’t address her Canadian property or local tax implications.

By engaging a Canada–U.S. wealth management firm, Emily gains clarity and alignment:

- Her RRSP contributions are optimized for both tax systems.

- Her Roth IRA is maintained as “grandfathered” under CRA guidance.

- Her investment portfolio avoids PFIC exposure by using U.S.-domiciled ETFs through a dual-licensed advisor.

- Her advisor coordinates with cross-border accountants to file all necessary forms.

- Her estate plan is updated to reflect assets in both countries.

This integrated approach not only reduces compliance risk but positions her for long-term tax efficiency and peace of mind—a perfect example of how comprehensive Canada U.S. Financial Planning delivers tangible results.

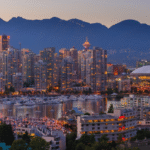

6. Vancouver’s Appeal—and Its Financial Implications

Vancouver’s lifestyle continues to attract Americans seeking opportunity and balance. The city’s economic strength, tech-driven job market, and Pacific gateway status make it ideal for professionals and retirees alike. Yet, these same advantages come with higher living costs, real estate challenges, and complex cross-border tax implications that require sophisticated Canada U.S. Tax Planning.

Real Estate and Primary Residence Planning

For U.S. citizens buying property in Vancouver, there are key considerations:

- Capital Gains on Sale:

Canada exempts the sale of a principal residence from capital gains tax, but the U.S. may still tax gains above $250,000 USD (single) or $500,000 USD (married). - Foreign Ownership Reporting:

Holding property through Canadian corporations can trigger IRS reporting obligations. - Currency Impact:

Gains or losses measured in U.S. dollars can differ from those in Canadian dollars due to exchange rate fluctuations.

Proper planning ensures your dream Vancouver home doesn’t become a tax headache later—a key outcome of forward-thinking Canada U.S. Financial Planning.

Philanthropy and Giving

Cross-border charitable giving also requires care. Donations to Canadian charities are not automatically deductible on U.S. returns unless the charity is registered under the Canada–U.S. Tax Treaty or operates as a U.S. 501(c)(3) affiliate. Strategic coordination ensures your generosity receives the intended tax benefits—another area where effective Canada U.S. Tax Planning adds value.

What This Means for You

If you’re an American expat living in Vancouver, you’re part of a growing community navigating life between two interconnected yet distinct financial systems. Your opportunities are vast—but so are the challenges.

What this means for you is simple: cross-border financial success demands proactive coordination. Whether it’s optimizing tax filings, managing investments, or preparing for retirement, every decision carries implications on both sides of the border.

Working with a Canada–U.S. expat advisor ensures your wealth plan reflects both countries’ laws and your long-term goals. With the right guidance in Canada U.S. Tax Planning and Canada U.S. Financial Planning, you can embrace Vancouver’s lifestyle with confidence—knowing your financial future is as balanced as your life across borders.

More Stories

Betting on Baccarat: Marketing Strategies for the Modern Online Casino

Niche is the New Norm: How Specialized Recruitment is Solving the Supply Chain Talent Crisis

Discover Why Rajiv Sharma Is the Best Sales Trainer in India: Transform Your Sales Team with Result-Oriented Training Programs